Income tax payment calculator

Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year. 1040 Tax Estimation Calculator for 2022 Taxes.

Income Tax Calculator For India Infographic Income Tax Income Budgeting Finances

Try now for Free.

. Ad Calculate your federal income tax bill in a few steps. Income Tax 000 20 over Compensation Level CL 000 5134 5134 Voila. See how your refund take-home pay or tax due are affected by withholding amount.

Your average tax rate is. It can also be used to help fill steps 3 and 4 of a W-4 form. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Your household income location filing status and number of personal. Tax Tax Free. How It Works.

You calculate depreciation as follows. Use Tax Calculator to know your estimated tax rate in a few steps. Ad Try Our Free And Simple Tax Refund Calculator.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. You bought the property 250000 and. Check your Income Tax payments for the current year.

Your average tax rate is. If you have more than one job use the calculator once for each job. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

100 Accurate Calculations Guaranteed. 15 Tax Calculators. Based on your projected tax withholding for the.

That means that your net pay will be 43041 per year or 3587 per month. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. One notable exception is if the 15th falls on a.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Federal or IRS Taxes Are Listed.

No tax on income between 1 - 18200. That means that your net pay will be 40568 per year or 3381 per month. Optional How to get your net take home pay.

For example if an employee earns 1500. Check how much you. That means you pay taxes on it at your regular income tax rate between 10-37 of your income.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The Oregon Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

To know how much. This means for an annual income of you pay. 5134 is our income tax.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Use our free income tax calculator to work out how much tax you should be paying in Australia. Enter your filing status income deductions and credits and we will estimate your total taxes.

Find Fresh Content Updated Daily For Estimated tax payment calculator. Use this tool to. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Estimate your federal income tax withholding. How to calculate annual income. FAQ Blog Calculators Students Logbook.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. There are different ways to. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Income Tax Calculator App Concept Calculator App Tax App App

Hmrc Tax Refund Calculator Will Guide You To Understand Whether You Are Eligible For A Refund From Hmrc Or Not Sinc Income Tax Return Income Tax Tax Return

Tax Calculator Calculator Design Calculator Web Design

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

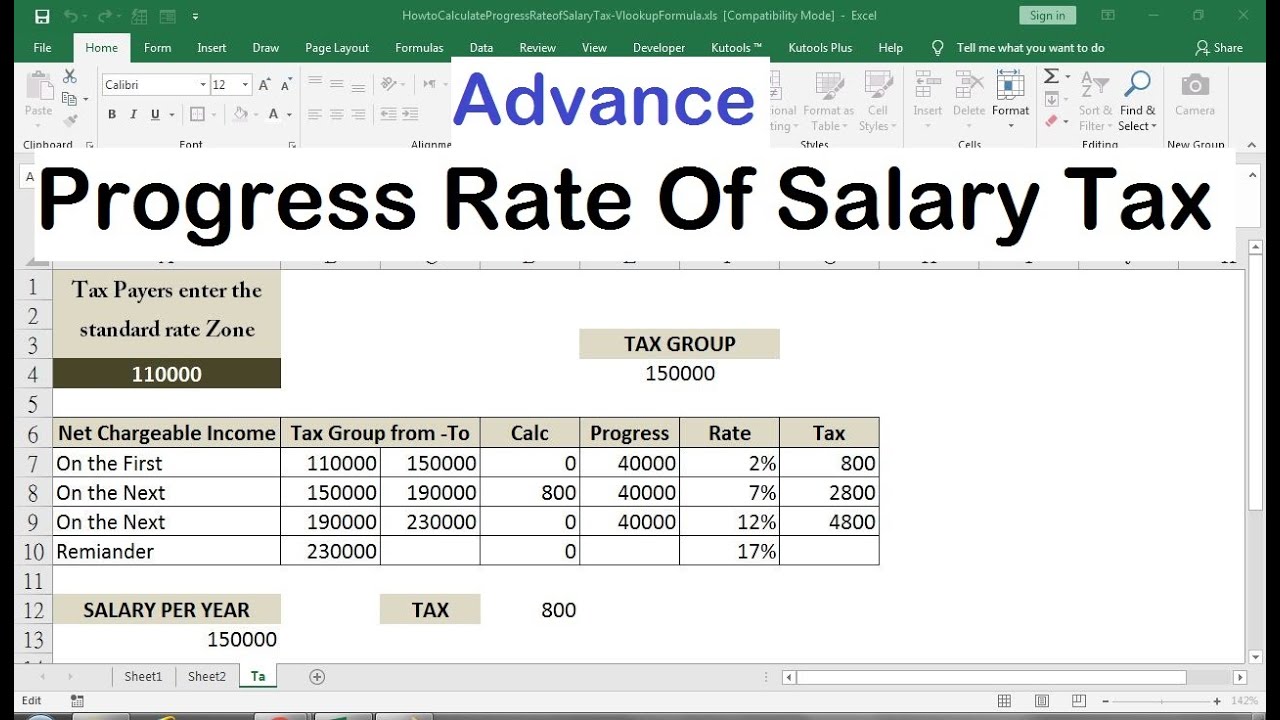

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Quarterly Tax Payment Calculator The Accountants For Creatives Quarterly Taxes Small Business Tax Tax Checklist

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Metaphors Ve Income Tax Tax Income

What Is Annual Income How To Calculate Your Salary

Income Taxes Preparing A U S Tax Form With Money In Mind Spon Preparing Taxes Income Tax Mind Ad Income Tax Income Tax

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Salary Calculator Salary Calculator Calculator Design Salary

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Self Employed Tax Calculator Business Tax Self Employment Employment

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Meta Filing Taxes Income Tax Income